FinOps, as a term, is a combination of Finance and DevOps, as it brings together the business and engineering sides of an organisation for collaboration. Often thought of as Financial Operations, it is better defined as a cloud financial management discipline and culture.

In our last blog post, Introducing FinOps, we went over the six key principles of FinOps and the three phases of FinOps management: Inform, Optimise and Operate. To explore those themes and some tips straight from our Azure Expert, Anthony Cooke, take a read of that post, here.

In this post, we are going to look at why you should implement FinOps along with some specific headwinds of 2023, making it a topic worth investigating. As well as some of the Microsoft tools available for cost-savings and implementation of an effective FinOps strategy in your organisation.

Why do I Need FinOps for Cloud Cost-Optimisation?

Cloud adoption and the usage of cloud technologies continue to grow across all organisation sizes and markets. One of the biggest challenges a company faces when adopting cloud technologies is switching from a traditional CapEX (Capital Expenditure) spending model to OpEx (Operating Expenditure), meaning cloud spend is tied to day-to-day operational spending instead of larger one-time purchases every few months or years.

The change in cost model introduces its own challenges for organisations, including unpredictable bills, spiralling costs, and cost inefficiencies due to waste. Due to the aforementioned challenges, it’s important that cloud spend is monitored and controlled correctly and that’s where FinOps can help.

A Quick Recap – What is FinOps?

FinOps is a set of practices and processes aimed at optimising cloud costs and maximising the value delivered by cloud services. FinOps combines principles of financial management, cloud operations, and cloud governance to help organizations understand and manage the financial impact of their cloud usage.

The goal of FinOps is to create a culture of accountability and collaboration between IT, finance, and business teams, allowing them to make data-driven decisions about cloud usage, optimise spending, and align cloud resources with business objectives. FinOps involves monitoring and analysing cloud costs, identifying cost drivers, and implementing policies and tools to optimise cloud usage and reduce waste.

In short, FinOps is a framework that helps organizations manage their cloud costs effectively, enabling them to make informed decisions about cloud investments and usage, and ensuring that they are getting the most value from their cloud resources.

Why Should I Implement FinOps?

With pressing assignments, underway projects and a task list up to the roof, you may be wondering why you should use your valuable time to focus on FinOps.

If you are like many organisations, you have been steadily moving your workloads to the cloud, partly for the opportunity for innovation it provides and partly for the promise of cost-savings over the traditional method of on-premises infrastructure. However, though the security, scalability and avenues for innovation have certainly delivered, the promised savings may not be in sight. If you’re overspending, looking at budget caps in your rearview mirror and wondering where the unplanned for costs are coming from, you are not alone.

This is exactly what many organisations are experiencing and with cloud usage decentralised across departments, it can be difficult to isolate where the overspend is occurring and who is responsible for resolving it.

FinOps is designed to help disparate teams speak the same language and manage costs without limiting or adding obstacles to the cloud. After all, there is no point in implementing this if it negates the innovation benefits of being in the cloud in the first place. If you want to continue with cloud uptake, usage, and innovation, then FinOps is a necessity, not a luxury.

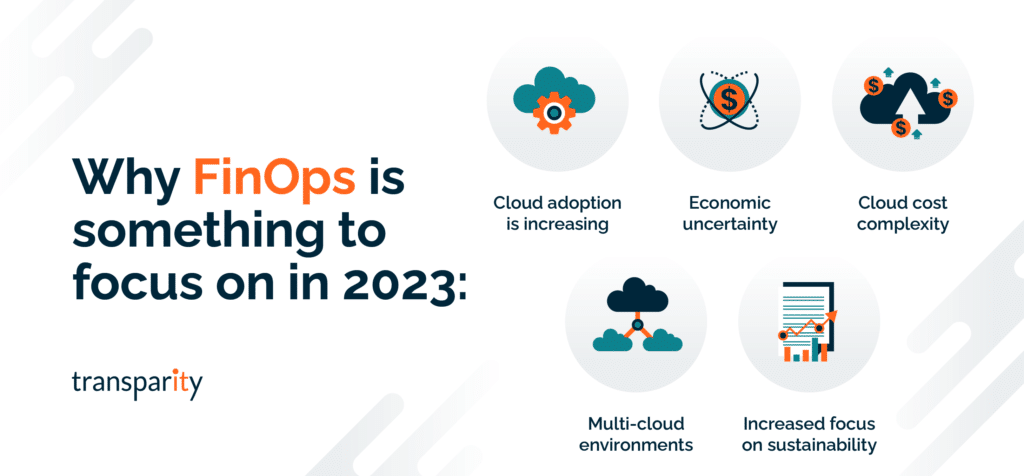

Why FinOps is something to focus on in 2023:

Though cloud financial management is never going to be unnecessary, with certain economic factors this year and a change in IT budgets and spending now is a very appropriate moment to be focussing on this topic.

- Cloud adoption is increasing: More and more organizations are moving to the cloud to take advantage of its scalability, flexibility, and cost-effectiveness. However, with increased cloud usage comes increased cloud costs, which can quickly add up if not managed properly. FinOps helps organizations keep cloud costs under control, ensuring that they are getting the most value from their cloud investments and not just swapping one inefficient cost for another.

- Economic uncertainty: The COVID-19 pandemic led to economic uncertainty and budget cuts for many organizations. FinOps can help organizations optimise their cloud spending, reducing costs and freeing up resources for other critical business initiatives.

- Cloud cost complexity: Cloud cost structures can be complex and difficult to understand, with multiple pricing models, usage tiers, and available discounts. FinOps provides a framework for analysing and optimizing cloud costs, helping organizations navigate the complexities of cloud pricing.

- Multi-cloud environments: Many organizations are using multiple cloud providers to take advantage of the unique features and services offered by each provider. However, managing costs across multiple cloud providers can be challenging. FinOps provides a standardised approach to managing cloud costs, regardless of the cloud provider.

- Increased focus on sustainability: As organizations become more aware of the environmental impact of their operations, they are looking for ways to reduce their carbon footprint. FinOps can help organizations optimise their cloud usage to minimize energy consumption and reduce their overall environmental impact.

Utilising Microsoft Azure for FinOps:

The range of discounts and tools available for cloud cost savings and optimisation is vast. Microsoft Azure alone provides a comprehensive set of tools and services to help organizations implement FinOps practices and if you are not making use of these, just this missing step alone is money going down the drain.

As a Microsoft Partner, we’d like to highlight just some of what is to offer for managing your cloud costs effectively within Azure. Here are some of the key features and capabilities of Microsoft Azure for FinOps:

- Azure Cost Management and Billing: Azure Cost Management and Billing is a tool that provides visibility and insights into your Azure spend, allowing you to monitor and optimise your cloud costs. It provides detailed cost analysis and reporting, budgeting and alerting capabilities, and recommendations for cost optimisation.

- Azure Advisor: Azure Advisor is a free service that provides personalised recommendations for optimising your Azure resources. It provides recommendations for cost optimization, security, performance, and availability.

- Azure Reservation Pricing: Azure Reservation Pricing allows you to save money on your Azure usage by pre-paying for compute resources. It provides significant discounts compared to pay-as-you-go pricing.

- Azure Hybrid Benefit: Azure Hybrid Benefit allows you to save money on your Azure usage by using your existing on-premises licenses for certain Microsoft software products. It provides considerable cost savings compared to using Azure’s pay-as-you-go licensing model.

- Azure Spot Virtual Machines: Azure Spot Virtual Machines allow you to take advantage of unused Azure capacity at a notably reduced cost. This can provide cost savings for non-critical workloads and help to optimise your cloud spending.

Overall, Microsoft Azure provides a robust set of tools and services to help organisations implement FinOps practices and manage cloud costs effectively. By leveraging these tools and services, organisations can optimise their cloud usage, reduce costs, and get the most value from their cloud investments.

There are many aspects to FinOps – remember it is a cultural practice, so the use of these tools alone is just one angle to address. Nevertheless, it can be a great place to start for quick cost-saving wins.

Transparity’s Azure Practice and FinOps

With a team of experts dedicated to infrastructure and the Azure cloud, our specialists have designed a full offering to help any organisation, no matter at what place in the journey, understand and implement FinOps. If you are interested in cost-optimisation and better cloud financial management, why not get in touch and find out how we can help.